The Biden administration is proposing a new student debt relief plan for those who don’t qualify for loan forgiveness.

The National Foundation for Credit Counseling’s Bruce McClary said, “This is the administration taking another stab at offering student loan forgiveness to a large number of student borrowers, many of whom have been struggling for years to repay the debt that they owe.”

According to the Department of Education four categories qualify:

- Those with a loan balance that exceeds the original amount that was borrowed

- Those whose loans were taken more than 25 years ago

- Those with loans that were taken as part of their career enhancement that led to “unreasonable debt loads or insufficient earnings.”

- Those who are eligible for forgiveness under other repayment plans but have not applied for it.

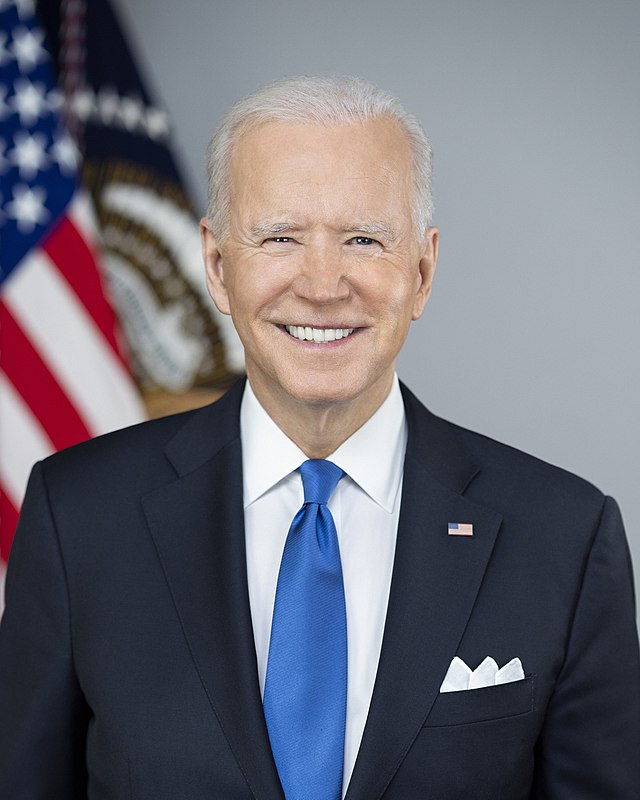

The new Biden plan

This aid is part of the $127 billion in loan forgiveness initiated by the Biden administration. McClary said that people should keep a close eye on their accounts and make sure all their information is up to date.

“This is especially critical right now, as we just exited this long period of administrative forbearance where people have been able to skip payments. And it’s one of those things where if it’s out of sight, it’s out of mind. If your servicer doesn’t know how to contact you, you could be missing out on some really important information, just like this information about whether or not you may qualify for forgiveness under the new program.”

McClary also warned of scam emails. He said that you should contact your servicer instead of responding directly to any email.

Details about how much borrowers can see from the proposal are yet to be finalized.

Loan repayments

Student loan repayments were resumed last month after a three year pause due to the pandemic. The Supreme Court however blocked President Biden’s plan to erase up to $20,000 in student debt for borrowers.

The resumption of payments has caused much financial hardship for Americans with some resorting to GoFundMe for help. The number of crowdfunding campaigns on GoFundMe which is tied to college loans has gone up 40%.

According to a survey in August from Credit Karma, half of student loan borrowers say they have had to choose between making loan payments when the forbearance period ended and covering basic expenses like rent and food. Food banks have also reported an increase in requests for help after the student loan payments have resumed.

Read More News

Conservatives saying liberal states are living in a dystopian society after locking up deodorant in stores

Cover Photo: Wikipedia