China is clamping down on investment bankers. At least three top investment bankers have been detained since August. One of them fled abroad but was arrested overseas about two weeks ago and brought back to China, reports Bloomberg.

State-backed brokerages recently asked many of their investment bankers to hand in their passports and seek permission for all business and personal travel plans.

Some bankers were told that regulators are scrutinizing initial public offerings and other capital-raising activities and they could be called in for questioning at any time.

Bankers, industry under a cloud

These are uncertain times for China’s army of 8,700 investment bankers.

China’s $1.7 trillion brokerage industry and domestic capital-markets activities were already under a cloud, affected by the economic slowdown. China’s state-owned financial institutions have capped annual pay for top executives at 2.9 million yuan ($400,000).

The authorities want to “profoundly change the distribution of the profit pie in the entire financial industry”, said Shen Meng, a director at Beijing-based boutique investment bank Chanson & Co.

Consolidation

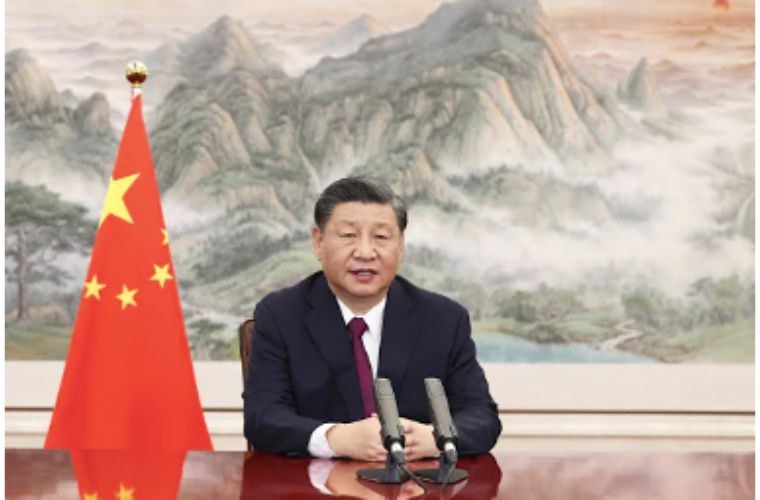

Earlier this month, Shanghai-based Haitong Securities Co agreed to combine with a larger state-backed rival, Guotai Junan Securities Co, in a share-swap deal that would create China’s largest brokerage by assets. The move comes after President Xi said China should cultivate a few top-ranked investment banks.

The deal also follows a drop in Haitong’s profits and the arrest of one of its top bankers. Jiang Chengjun, a deputy general manager who oversaw investment banking, was arrested in late August. On August 28, Haitong reported a 75 per cent drop in first-half profit to 953 million yuan.

Layoffs are likely at Haitong.

The other two top investment bankers arrested recently are Wang Zhaoping, a former vice general manager of Shenwan Hongyuan Group, and Wang Chen, head of investment banking division at Guoyuan Securities Co.

Clean-up

Beijing has been trying to clean up China’s $66 trillion financial sector since at least 2021, when President Xi declared war on corruption in the industry. Numerous financial professionals have been arrested. Some have been sentenced to death or jailed for life.

Sun Jianbo, president and founder of Beijing-based asset manager China Vision Capital, said the industry needs consolidation and a regulatory crackdown because the investment banks had largely offered “inadequate” services.

“We don’t need that many investment banks and cutting redundant bankers is the first and necessary step for China to cultivate top-class investment banks,” said Sun. “We’ll inevitably see faster consolidation and potentially more personnel investigations in the future.”