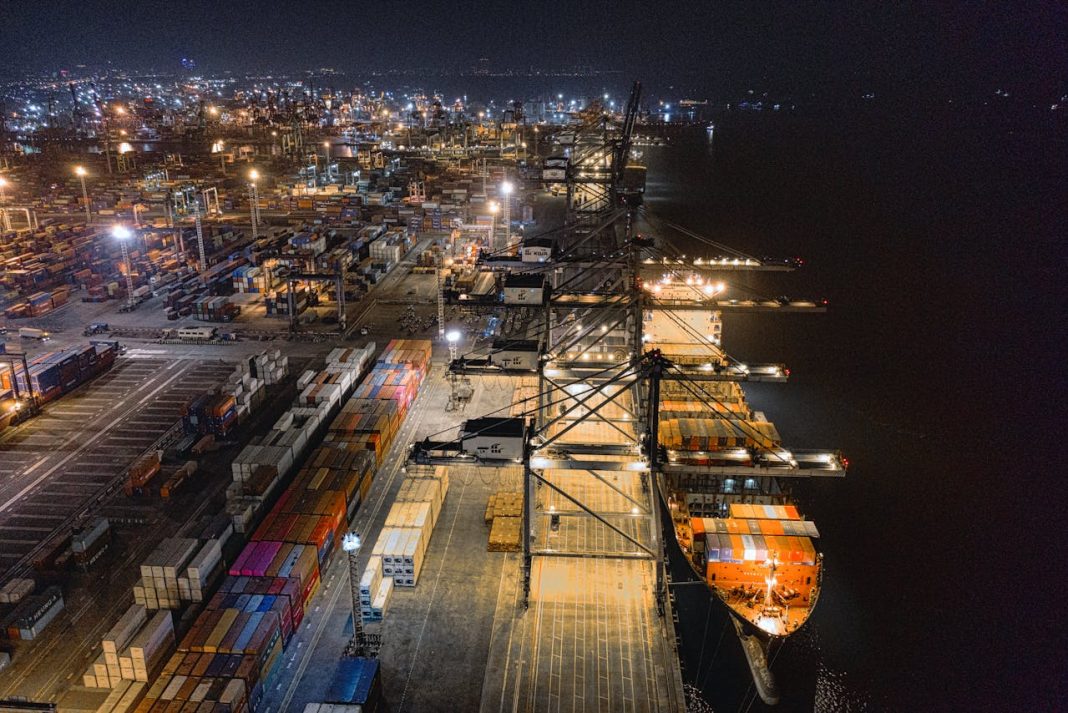

SINGAPORE: While fears over inflation appear to have subsided, Singapore’s fund managers are now confronting a fresh set of challenges — geopolitical conflicts and escalating trade tensions.

According to the latest Investment Managers’ Outlook Survey by the Investment Management Association of Singapore (IMAS), published by the Singapore Business Review, over half (56%) of fund managers are bracing for the potential impact of geopolitical instability on global financial markets and the broader economy.

Alongside geopolitical concerns, more than half (54%) of respondents also expressed unease about rising trade tensions, with a notable 23% forecasting that a weaker China could significantly affect market dynamics.

These developments highlight the uncertainty investors are navigating in the current global landscape.

On the monetary front, three-quarters (75%) of fund managers expect the US Federal Reserve to reduce interest rates by up to 0.75 percentage points throughout 2025, a move that would likely ripple across markets worldwide.

For Singapore’s asset management industry, key risks identified include the accelerated shift towards passive investment solutions, ongoing pressure on profit margins, and changing investor preferences.

In response to these challenges, industry leaders are being urged to diversify their offerings, with a particular emphasis on emerging asset classes like private markets.

Additionally, there is a growing push to leverage cutting-edge tools such as generative AI to unlock new growth opportunities and enhance value creation.

Thomas Kaegi, Chairman of the IMAS Development Committee, noted, “Companies are addressing the ongoing threat to their margins by expanding into new asset classes and broadening their distribution channels. These trends signify a transformative shift in the industry, driven by a need to meet evolving client demands and capitalize on future growth potential.”

As 2025 progresses, fund managers are also weighing predictions for currency movements.

While opinions on the Chinese yuan remain divided, with 37% forecasting a 5-10% weakening to 7.22 USD/CNY, the majority (63%) believe the yuan will either stabilize or appreciate.

Meanwhile, the US dollar is expected to moderate against the Singapore dollar, with a forecasted rate of 1.34 USD/SGD by the end of the year. Oil prices are also projected to stabilize around US$72.40 per barrel.

As geopolitical risks, trade tensions, and shifting market dynamics take centre stage in the coming months, Singapore’s fund managers will need to navigate these challenges while adapting to an ever-evolving financial landscape.